2050.

10 Billion People.

A Hotter Planet.

More Crowded Cities.

Invent City, an initiative designed to accelerate getting critical urban responses to the climate crisis to changing popuplations deployed. An economics strategy that transform NYC's Financial District (FiDi) into an urban-focused industrial cluster. Anchored by a trade mart, powered by an AI urban nervous system, and strengthened by media. NYC's Economic Opportunities

Economic benefit to NYC

Tourism

Economic Activity: $1.57B/year

Job Creation: 7,700

Tax revenues: $135M/year

Trade Mart

Job creation: ≈9,846–11,300

Tax revenues: $41.47M/year

Economics is the engine of change — when capital moves, problems move. Profit meets purpose, momentum builds, and transformation follows.

Inaction Bleeds Cities — Delay is collapse. Floods wreck grids, heat strains power, housing gaps widen unrest. Insurance spikes. Investors flee. Doing nothing costs more every day—it’s decline on autopilot.

Action Builds Power — Climate action isn’t a cost—it’s the growth engine. Clean power, housing, resilient grids fuel jobs, innovation, and confidence. Cities that move first win capital, talent, and future advantage.

Invent City ignites a high-impact urban solutions hub — co-located teams move faster, hire smarter, and attract serious capital. From Silicon Valley to Shenzhen: visibility drives velocity. More on Clusters Michael Porter

Cluster Advantage

1. Full Ecosystem

Clusters bring the whole value chain—startups, scaleups, builders, backers—into one ecosystem. Climate tech next to capital. Transit next to data. Faster from idea to market.

2. Innovation Engine

Shared R&D drives breakthroughs. Universities, labs, and testbeds feed talent and IP. Incubators and digital twins turn concepts into investable products.

3. Capital & Markets

Clusters attract money. VC, procurement, and trade marts put buyers at the door. Showrooms and deal days close gaps between pitch and purchase.

4. Built to Work

Workspaces, zero-carbon utilities, shared prototyping, and 5G logistics. The cluster is both infrastructure and showcase—every asset proves its value in real time.

5. Clear Governance

A neutral operator keeps it tight: aligns partners, tracks impact, builds brand, and manages shared data—secure, ethical, valuable to all.

6. Global Stage

The brand drives export. Unified identity, global ties, and headline events turn the cluster into a magnet. When buyers want to see the future, they come here.

Cluster Economic Model

Clusters Worldwide

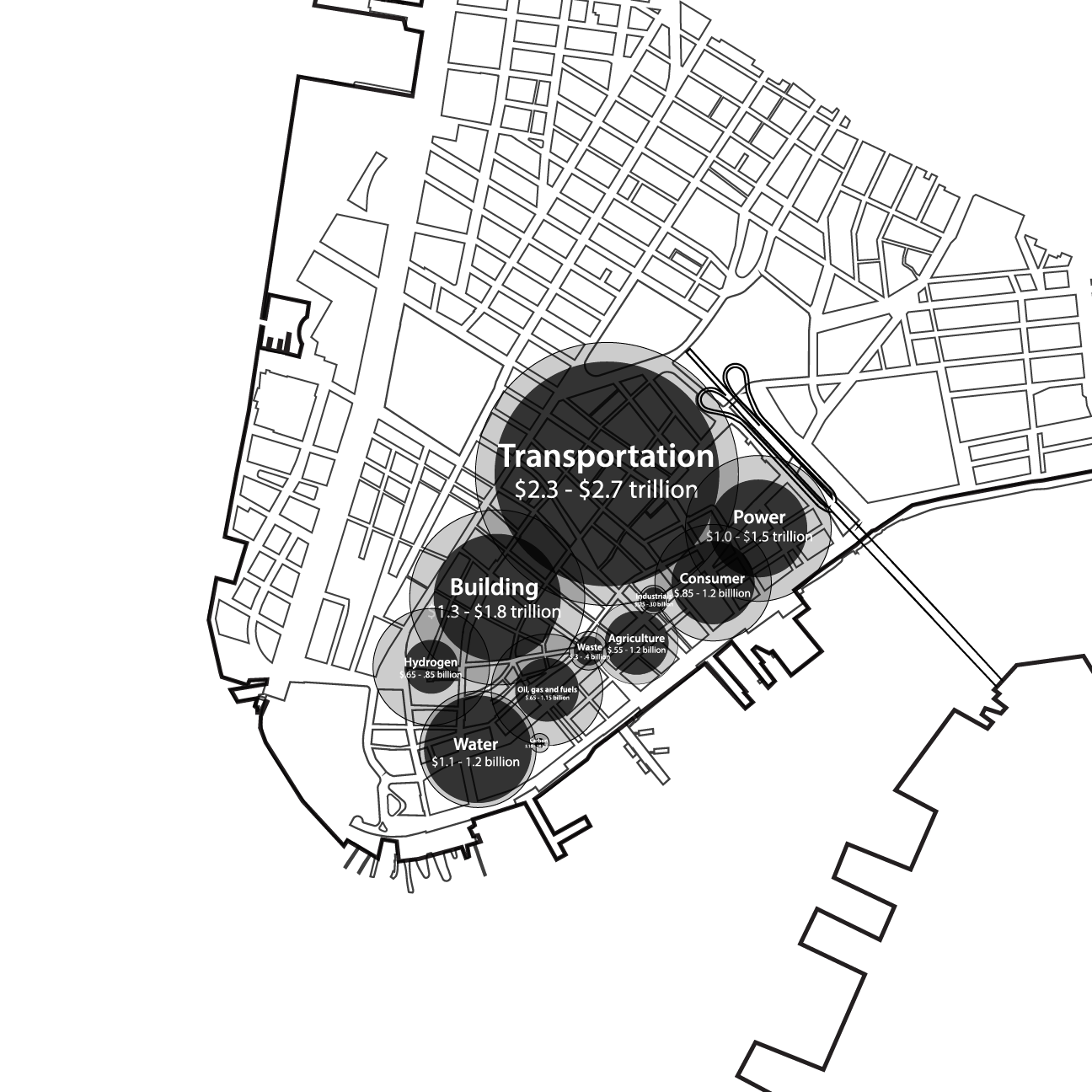

Urban industries are racing to meet the climate and population crunch — Invent City will put high-growth sectors on the front line to showcase, sell, and scale real solutions for tomorrow’s cities.

Click image to open

The Trade Mart anchors the cluster — a high-impact hub where buyers meet sellers, deals flow nonstop, and foot traffic fuels visibility, momentum, and growth in the cluster.

Trade Marts Worldwide

Inside the Trade Mart, every showroom is a high-performance sales engine—run by each brand, built for speed, and tuned for growth — Flexible, focused, and built to convert. No noise. No limits.

Location is leverage — The right hub cuts friction, connects markets, and attracts top talent. Even in an AI-driven world, geography wins. Position is power.

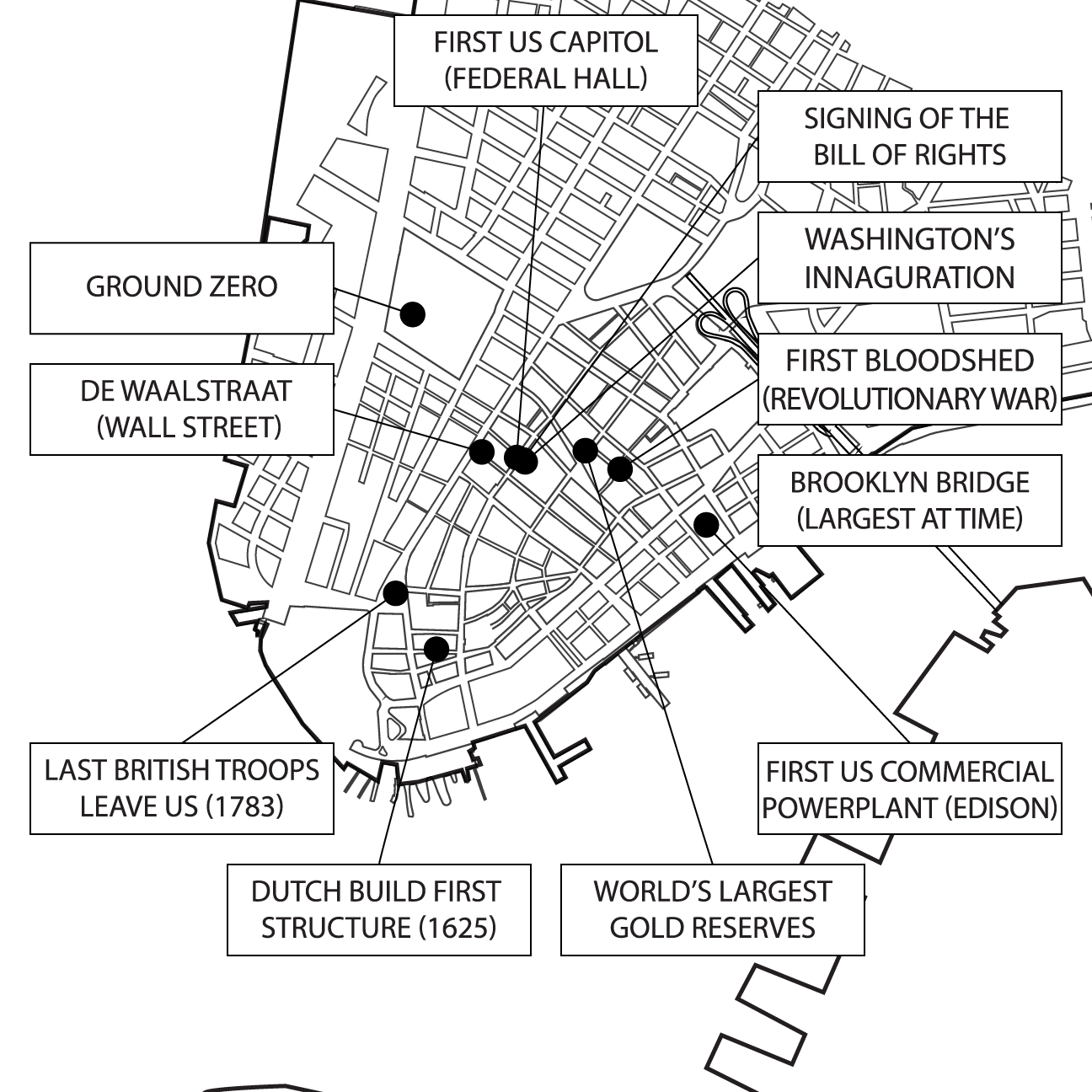

It Starts With NYC — Home to the UN, Wall Street, and 120+ consulates, NYC leads in finance, diplomacy, and media. Its STEM talent rivals Silicon Valley, backed by investors and constant visibility. The world’s launchpad for scale.

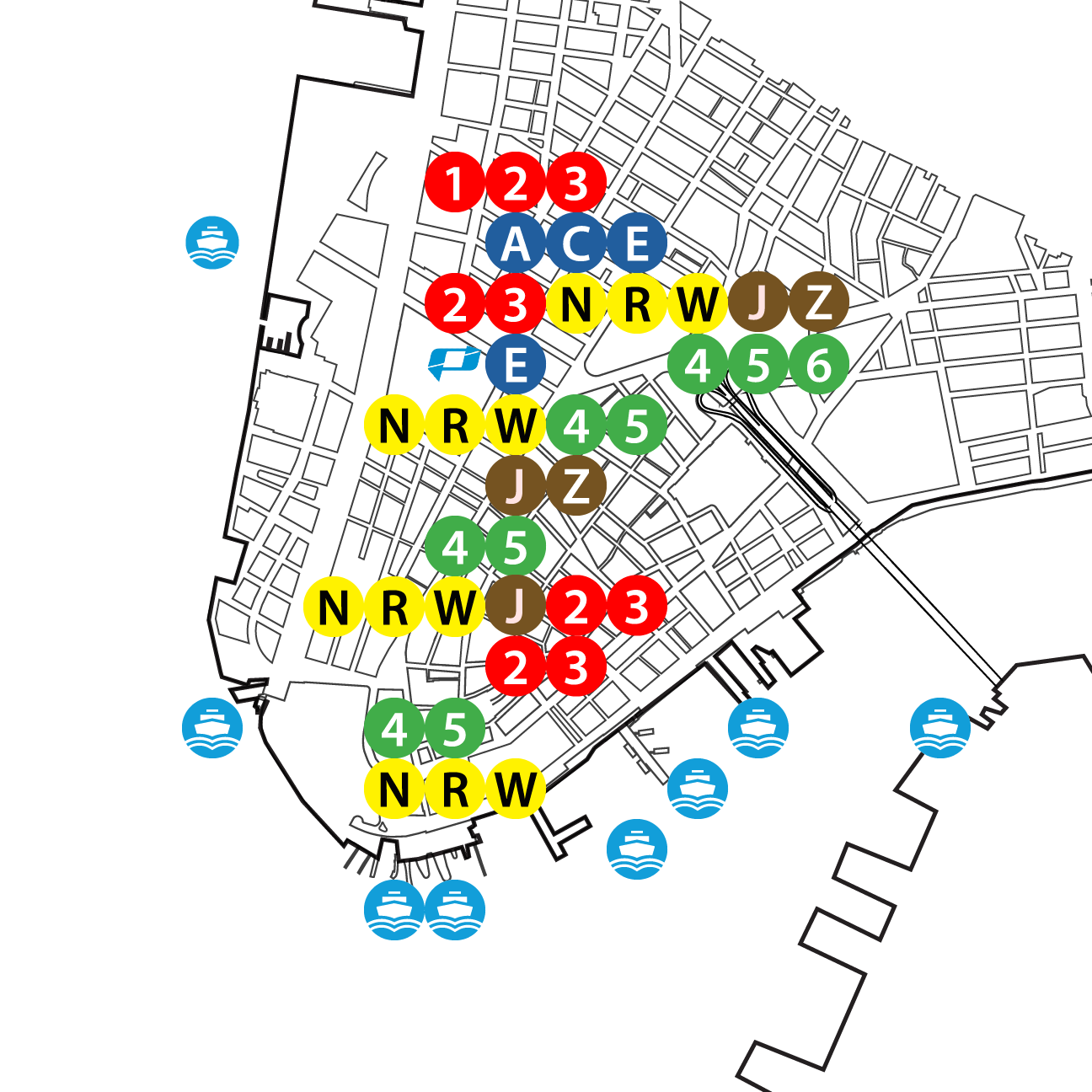

FiDi Is the Edge — Historic clout meets open potential. Global name, unmatched transit—13 subways, ferries, PATH, Citi Bike—and millions of square feet ready to repurpose. From Edison’s grid to Wall Street’s rise, FiDi builds what’s next.

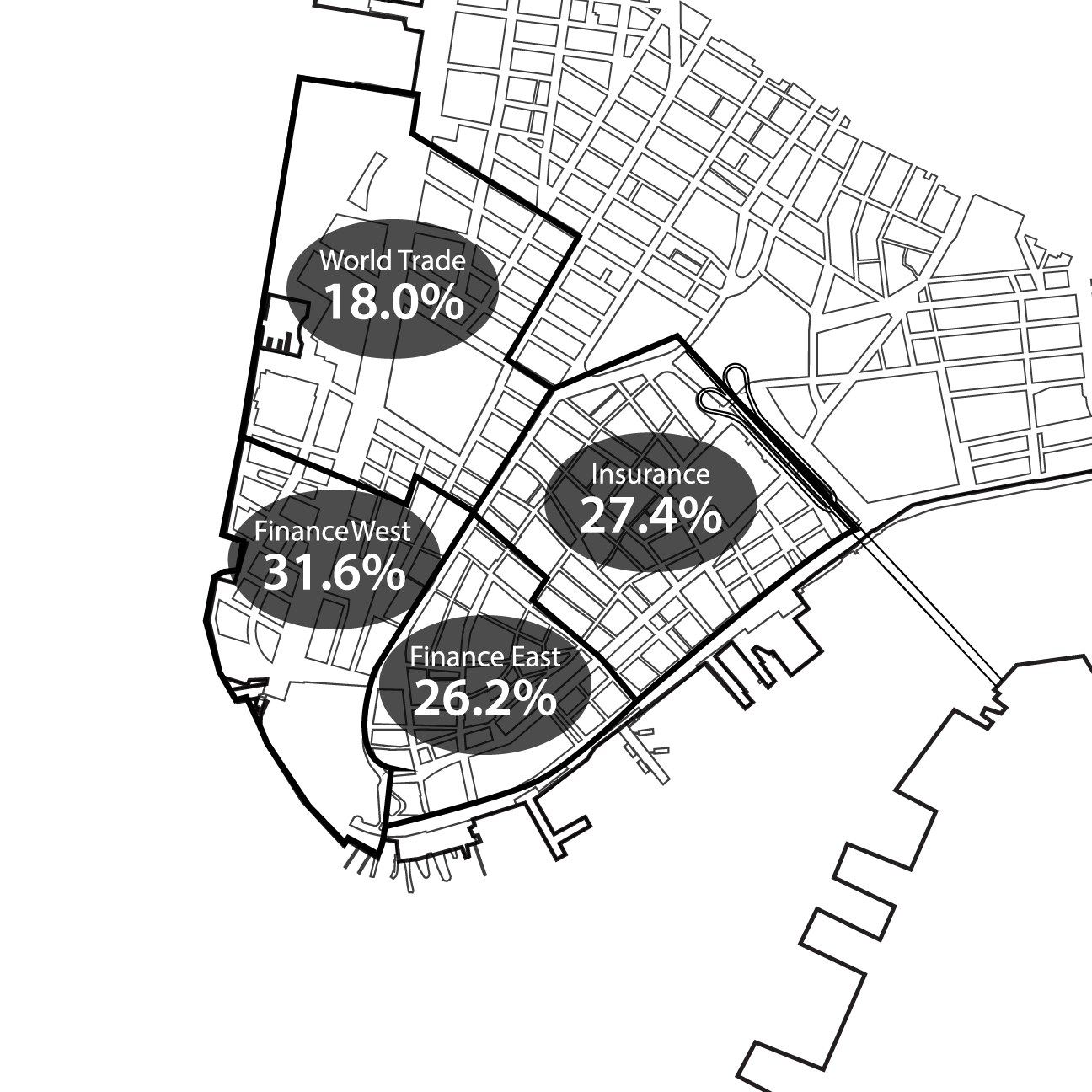

Vacant office and retail floors convert fastes and cheapest into showrooms — They need minimal structural change, lower capital outlay, and short build times. Compared to residential conversions, they deliver quicker ROI, lower risk, and faster impact.

| SUPPLY | ||

|---|---|---|

| Category | Inventory | Vacant |

| Finance West | 6,211,658 sf | 2,103,351 sf |

| Insurance | 12,587,451 sf | 4,678,003 sf |

| World Trade | 24,144,411 sf | 4,814,215 sf |

| Finance East | 29,924,952 sf | 7,966,073 sf |

| Totals | 72,868,472 sf | 19,561,642 sf |

| DEMAND | |

|---|---|

| Category | Area Needed |

| Invent City Direct | 1,000,000 sf |

| Invent City Indirect | 2,000,000 sf |

| Totals | 3,000,000 sf |

Urban Hubs

As a backbone, and Coomplementing the Blue Highway of using particularly the East River for crgo, Invent City will encourge the development of urban hubs. micro-cargo, micro-transit, neighborhood garbage transfer, public toilets.

An urban “nervous system” for the cluster and trade mart — A shared data spine links every part of the cluster and Trade Mart. Open APIs. Certified metrics. Predictive, adaptive, finance-ready. What was once fragmented becomes a living, optimizing system.

AI Already Changing NYC

New York City is already putting AI to work across several sectors. From civic chatbots to predictive flooding models, AI is improving daily life, accelerating service delivery, and making the city safer and more sustainable.

| AI.NYC — The city’s central AI community platform connecting builders, investors, and innovators through events and roundtables. |

| NYC AI Nexus — A NYCEDC initiative accelerating AI innovation via startup accelerators and industry partnerships. |

| Empire AI — A $400 million public-private partnership launched by New York State to fund AI research and development. |

| NYC Office of Technology & Innovation (OTI) — Released the city’s first AI Action Plan for responsible, transparent AI use across agencies. |

| NYAI — A long-running community for AI founders, builders, and investors showcasing new tools and ideas in AI, ML, and data. |

And Cities Worldwide

Invent City never sleeps — Its marketing engine runs nonstop, turning moments into momentum. Live events, digital drops, and immersive media keep the Trade Mart buzzing long after the handshake. Synced to real-time trends, fueled by data, and built to scale, Invent City grows from local platform to global magnet—city by city, market by market.

BENEFITS to nyc,

to companies,

to the planet

Economic Engine — Backed by NYC Tourism + Conventions, NYCEDC, the Port Authority, and city/state comptrollers, Invent City drives $1.6 B in annual output, $135 M in tax revenue, and nearly 8,000 new jobs.

Self-Reinforcing Growth — Showrooms and offices convert vacancy into value. Each tenant attracts vendors, demand, and momentum—fueling jobs, modernization, and higher tax rolls.

Tourism & Business Travel — As a global hub for urban innovation, Invent City draws investors, buyers, and events that fill 10,000 + hotel rooms while showcasing NYC’s leadership in future-city solutions.

Local Business Impact — Startups and global firms keep restaurants, cafés, and local services busy year-round. Pilots and contracts create steady work in construction, retrofits, and digital infrastructure—building skilled jobs and community resilience.

Regional Spillover — Demand radiates statewide. Suppliers, fabricators, logistics, and tech support across the tri-state region gain new contracts—strengthening industrial zones and service hubs beyond the city.

$1.57 B in annual tourism-driven spending

Boosted by Invent City, visitors drive local impact through hotels, food, transit, and more.

| Stay | Origin | Purpose | Visitors | Per-trip Spend | Direct | Indirect + Induced | Total Impact |

|---|---|---|---|---|---|---|---|

| Overnight | Domestic | Business | 504,000 | $860 | $433,440,000 | $238,392,000 | $671,832,000 |

| Overnight | Domestic | Leisure | 126,000 | $400 | $50,400,000 | $27,720,000 | $78,120,000 |

| Overnight | Int’l | Business | 216,000 | $2,000 | $432,000,000 | $237,600,000 | $669,600,000 |

| Overnight | Int’l | Leisure | 54,000 | $1,538 | $83,052,000 | $45,678,600 | $128,730,600 |

| Day | Domestic | Business | 56,000 | $160 | $8,960,000 | $4,928,000 | $13,888,000 |

| Day | Domestic | Leisure | 14,000 | $160 | $2,240,000 | $1,232,000 | $3,472,000 |

| Day | Int’l | Business | 24,000 | $160 | $3,840,000 | $2,112,000 | $5,952,000 |

| Day | Int’l | Leisure | 6,000 | $160 | $960,000 | $528,000 | $1,488,000 |

| Totals (annual) | $1,014,892,000 | $558,190,600 | $1,573,082,600 | ||||

$135 M / year in added tax revenue

Generated by visitor spending on hotels, restaurants, and transit near Invent City.

| Stay | Origin | Purpose | Taxes @ 8.61 % |

|---|---|---|---|

| Overnight | Domestic | Business | $57,844,735 |

| Overnight | Domestic | Leisure | $6,726,132 |

| Overnight | Int’l | Business | $57,652,560 |

| Overnight | Int’l | Leisure | $11,083,705 |

| Day | Domestic | Business | $1,195,757 |

| Day | Domestic | Leisure | $298,939 |

| Day | Int’l | Business | $512,467 |

| Day | Int’l | Leisure | $128,117 |

| Totals (annual) | $135,442,412 | ||

7,726 tourism-supported jobs per year

From hotels to logistics, visitor spending powers thousands of city jobs.

| Stay | Origin | Purpose | Direct Spend | Indirect + Induced (0.55×) | Total Impact (1.55×) | Jobs Supported |

|---|---|---|---|---|---|---|

| Overnight | Domestic | Business | $433,440,000 | $238,392,000 | $671,832,000 | 3,300 |

| Overnight | Domestic | Leisure | $50,400,000 | $27,720,000 | $78,120,000 | 384 |

| Overnight | International | Business | $432,000,000 | $237,600,000 | $669,600,000 | 3,289 |

| Overnight | International | Leisure | $83,052,000 | $45,678,600 | $128,730,600 | 632 |

| Day | Domestic | Business | $8,960,000 | $4,928,000 | $13,888,000 | 68 |

| Day | Domestic | Leisure | $2,240,000 | $1,232,000 | $3,472,000 | 17 |

| Day | International | Business | $3,840,000 | $2,112,000 | $5,952,000 | 29 |

| Day | International | Leisure | $960,000 | $528,000 | $1,488,000 | 7 |

| Totals (annual) | $558,190,600 | $1,573,082,600 | 7,726 | |||

Accelerated Growth — Concentrates qualified buyers and sellers in one hub, shrinking sales cycles and scaling revenue fast.

Partnership Engine — Aligns suppliers, financiers, and design teams—turning fragmentation into deal-ready collaboration.

Idea to Impact — Live testbeds and digital twins let innovators pilot, prove, and scale with speed and confidence.

Frictionless Finance — On-site capital, legal, and insurance support clear bottlenecks and move projects to market.

Demand Magnet — Showrooms and marquee events keep companies visible—driving leads, credibility, and market pull.

Mainstream Momentum — Converts proven solutions into mainstream adoption—bridging the gap from pilot to scale.

Return on Action — Participants cut costs, close faster, and grow recurring revenue—proof that low friction yields high return.

Next-Gen DOOH District — Turns FiDi into a living digital-out-of-home zone where residents navigate smarter, visitors move easier, and brands gain constant exposure.

Full-Network Integration — Connects to NYC’s media backbone—OUTFRONT, Intersection, JCDecaux, Westfield, Pearl Media—creating a unified citywide platform.

Action-Driven Engagement — The Invent City App links every screen to instant action—scan, tap, book, or RSVP—bridging awareness to measurable results.

Retail Impact Without Crowds — Delivers retail-level lift without heavy foot traffic—ideal for reusing under-occupied FiDi offices.

Real Estate Catalyst — Anchors FiDi’s revival by converting empty floors into showrooms and training centers—modeled on London’s Chelsea Harbour (1.5 sf office per 1 sf showroom).

Faster Leaner Redevelopments — Provides a quicker, lower-cost path to occupancy and value than residential or other slow, capital-heavy conversions.

Global Accelerator — Invent City positions NYC as a powerhouse for climate innovation—showcasing scalable solutions that drive resilience, growth, and global replication.

Faster Climate Deployment — Speeds adoption of proven technologies across energy, buildings, and transport—helping NYC hit net-zero sooner.

Elevated Leadership — Reinforces New York’s role as a global model for sustainable urban transformation.

Innovation-Driven Growth — Attracts industries, startups, and investors—turning innovation into jobs and prosperity.

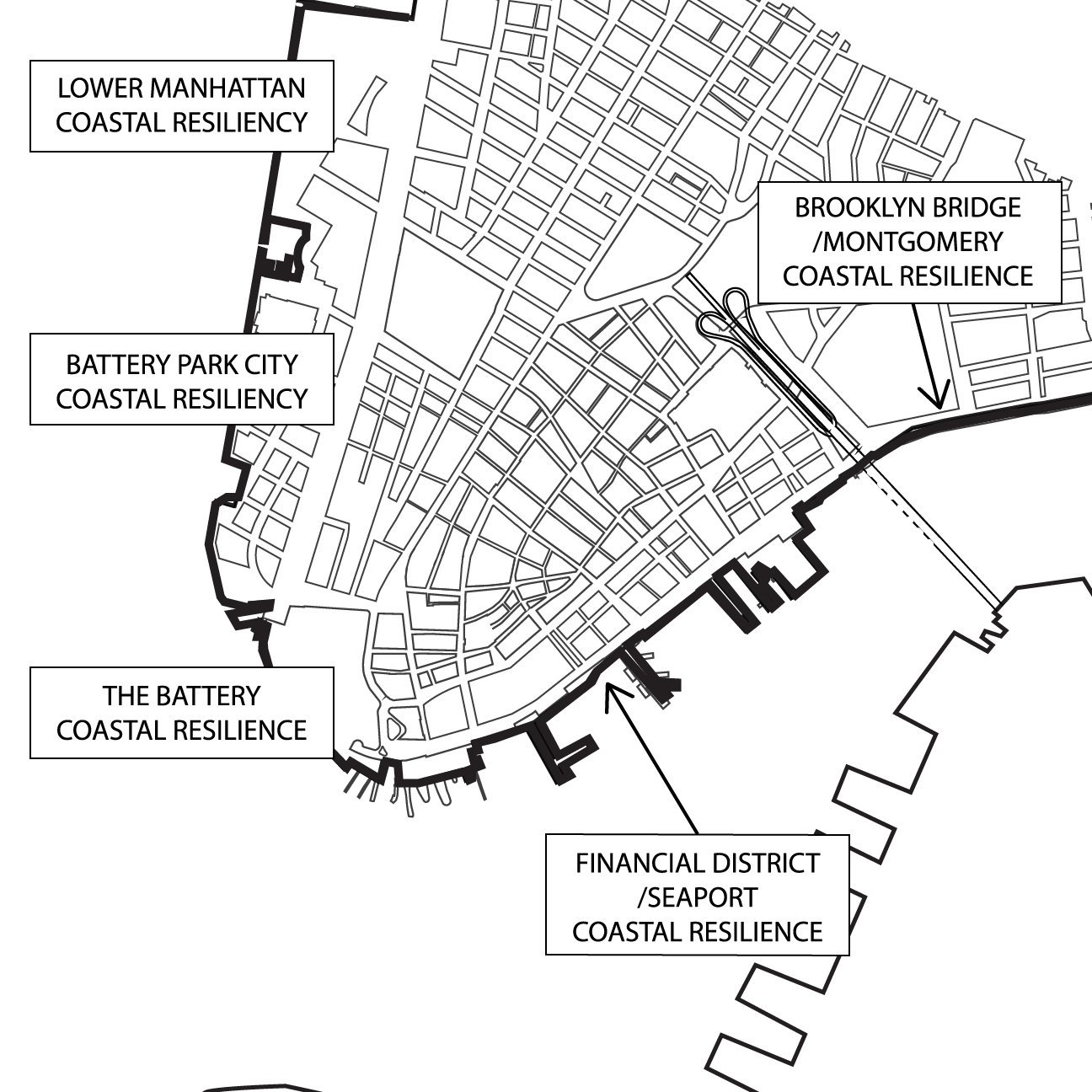

Nature-Based Resilience — Integrates greening, stormwater, and adaptive landscapes that cool, protect, and strengthen FiDi.

Public Engagement — Immersive showrooms and pilots let people see and experience the future of sustainable living.

Replicable Blueprint — Creates a carbon-zero model any dense, historic city can follow to thrive in the climate era.

Government & Civic

AI speeds permit reviews at 120 Broadway and 55 Water, powers the MyCity chatbot, and auto-routes 311 requests using traffic and event forecasts. A new NY law now requires agencies to disclose AI use.

Safety & Resilience

Digital twins prepare the Seaport–Battery for floods. AI scans CCTV at Fulton Center, Oculus/WTC, and Wall Street, flags HVAC/barrier faults; NYPD deploys robots under the POST Act; subway AI weapon scanners are under review.

Infrastructure & Sustainability

AI coordinates LL97 retrofits from Broadway to Water Street, manages grid peaks with chillers and batteries, monitors pumps and HVAC, tracks floods in real time, and targets tree canopy to cool Gold Street and Hanover Square.

Economy & Industry

Showrooms and trade-mart activity convert meetings into deals—accelerating pilots, procurement, and jobs. NYC’s AI-enabled urban solutions market draws private capital toward scalable deployments across buildings, mobility, power, and water.

Education

DOE pilots use AI to support personalized learning and tutoring, while admin tools streamline services and communications—freeing educators to focus on teaching.

Mobility

AI optimizes ferry headways, cargo curb access, and traffic signal timing; predicts subway crowding; and rebalances Citi Bike fleets—cutting delays and emissions across the network.

Homelessness & Social Services

Data tools help target outreach, predict shelter demand, and match services faster—linking housing, health, and employment supports to reduce instability.

MyCity & Digital Services

NYC’s MyCity chatbot answers common questions, streamlines permits and benefits screening, and routes requests to the right teams—reducing wait times and call volumes.

Flooding & Digital Twins

City digital twins predict flooding in real time, helping Seaport teams pre-stage barriers, reroute traffic, and protect critical equipment during storms.