2050.

10 Billion People.

A Hotter Planet.

More Crowded Cities.

Invent City turns NYC’s Financial District into a launchpad for solving climate, AI, and urban challenges. At its core: an industrial cluster anchored by an Urban Trade Mart, where companies showcase real solutions and strike real deals. Wrapped around it: events, popcasts, and metaverse reach. Built for speed. Designed for impact. Big upside for cities. Bigger upside for NYC >

Strategy to

Make FiDi a

Preeminent Solutions

Epicenter

Economic Drivers. AI is rewriting work, the climate crisis is testing infrastructure, and population shifts are straining housing and services. Invent City begins with these forces and how they are pushing cities to adapt fast.

Click for more info

Focus on Value Creation. Invent City's approach is to highlight the creation of value to cities and all stakeholders including the city and neighborhoods, univeristies, companies and investors, as well as others.

Recipients of Value >Cost and benefit. Cities generate the most emissions, take the hardest climate hits, and gain the most from acting fast. AI is now the leading investment category and will reset how cities plan and run. Climate costs keep rising, turning inaction into an economic risk. Population shifts raise the stakes. Lagos must build resilience. Tokyo must reinvent. When profit meets purpose, cities accelerate.

Industrial Cluster. A cluster is a dense network of talent, teams, and capital focused on the same problem. The model works. Companies hire faster, test faster, and win faster. Cities gain jobs, tax revenue, and global pull. Better products reach the market sooner, driving growth and profit. A FiDi-based cluster can position the city as a leader in urban innovation.

Industries in an Urban Cluster. Invent City is focusing on the valuable front end of industries across the spectrum.

| Transportation | $5–6T by 2050 |

| Buildings | $4–5T by 2050 |

| Power | $6–9T by 2050 |

| Waste & Materials | $1–2T by 2050 |

| Urban Agriculture | $0.8–1.1T by 2050 |

| Consumer Products | $1–1.3T by 2050 |

| Energy | $3–4T by 2050 |

| Water | $1–2T by 2050 |

| Wastewater | $1–1.3T by 2050 |

Clusters Worldwide. Around the world, industries concentrate where shared talent, infrastructure, and know-how speed up innovation. Silicon Valley leads in tech, Shenzhen in electronics, Detroit in autos, Emilia Romagna in machinery, and Bangalore in IT. These hubs grow because proximity helps companies move faster and compete harder.

Bringing together buyers and sellers.A velocity engine that gets solutions deployed worldwide. Buyers find answers fast. Sellers hit real demand. The model is proven. Invent City turns the entire city into a live showcase.

Inside the Trade Mart, companies operate dedicated showrooms—some solo, others grouped by sector, region, or under shared banners like city-led incubators. This isn’t a mall—it’s a high-performance sales engine. Each space is optimized for speed, conversion, and scale. Trade marts are proven. They can deliver strong commercial returns with lower risk.

Fast-to-launch spaces that let brands sell continuously, not just at events.

Transportation $5–6T by 2050

Buildings $4–5T by 2050

Power $6–9T by 2050

Waste & Materials $1–2T by 2050

Urban Agriculture $0.8–1.1T by 2050

Consumer Products $1–1.3T by 2050

Energy $3–4T by 2050

Water $1–2T by 2050

Wastewater $1–1.3T by 2050

| Transportation Industry Segments |

|---|

| Electric & Hydrogen Vehicles — Replacing internal combustion. (~$2.5–3.5T/yr) |

| Electrification of Public Transit — Greener buses, trains, ferries. (~$0.8–1.2T/yr) |

| Biking & Pedestrian Infrastructure — Active mobility. (~$0.3–0.6T/yr) |

| Water-Based Transit — Electric ferries & boats. (~$0.1–0.2T/yr) |

| Smart Traffic Management — AI congestion reduction. (~$0.2–0.4T/yr) |

| Mobility Hubs & Shared Vehicles — Integrated EVs + transit. (~$0.5–0.8T/yr) |

| Climate-Resilient Infrastructure — Storm-ready systems. (~$0.3–0.5T/yr) |

| Greener Shipping & Last-Mile Delivery — Electrified logistics. (~$0.4–0.7T/yr) |

| Policy & Public Engagement — Incentives & regulation. (~$0.1–0.2T/yr) |

| Buildings Industry Segments |

|---|

| Energy-Efficient Design — Passive strategies. (~$1.0–1.5T/yr) |

| Smart Building Technologies — Sensors + automation. (~$0.6–0.9T/yr) |

| Renewable Energy Integration — Solar + storage. (~$0.8–1.2T/yr) |

| Low-Carbon Construction Materials — Cement alternatives. (~$0.5–0.8T/yr) |

| Climate-Resilient Architecture — Heat/flood protection. (~$0.3–0.6T/yr) |

| Vertical Green Spaces — Roofs + walls. (~$0.1–0.3T/yr) |

| Water Management Systems — Reuse & stormwater. (~$0.2–0.4T/yr) |

| Retrofitting Older Buildings — Efficiency upgrades. (~$0.8–1.2T/yr) |

| High-Efficiency Equipment — HVAC & appliances. (~$0.5–0.8T/yr) |

| Sustainable Design — Biomimicry + circular. (~$0.2–0.4T/yr) |

| Power Industry Segments |

|---|

| Renewable Power — Solar, wind, hydro, WTE. (~$1.5–2.5T/yr) |

| Smart Grids & Grid Modernization — Microgrids, EV-integration. (~$0.8–1.2T/yr) |

| Energy Storage — Batteries + hydrogen. (~$0.7–1.0T/yr) |

| Decentralized Systems — Local micro sources. (~$0.3–0.5T/yr) |

| Electrification — Buildings + transport. (~$1.0–1.5T/yr) |

| Resilience & Grid Hardening — Storm-proofing. (~$0.4–0.7T/yr) |

| Carbon Capture & Hydrogen — Hard-to-electrify sectors. (~$0.5–0.9T/yr) |

| Decommissioning & Transition — Fossil → clean. (~$0.2–0.4T/yr) |

| Energy Equity — Affordable access. (~$0.1–0.3T/yr) |

| Waste Industry Segments |

|---|

| Zero-Waste Initiatives — Reuse + bans. (~$150–200B/yr) |

| Advanced Recycling — Chemical + AI. (~$180–250B/yr) |

| Organic Waste — Composting. (~$100–140B/yr) |

| Waste-to-Energy — Power from waste. (~$130–180B/yr) |

| Circular Economy — Industrial reuse. (~$120–160B/yr) |

| Smart Waste Collection — Sensors + routing. (~$70–100B/yr) |

| Landfill Reduction — Diversion. (~$60–90B/yr) |

| Plastic Reduction — Alternatives & policy. (~$90–120B/yr) |

| Sustainable Materials — Circular design. (~$80–110B/yr) |

| Methane Capture — Gas recovery. (~$50–80B/yr) |

| E-Waste Management — Electronics reuse. (~$100–130B/yr) |

| Industrial Processing — Reprocessing + upcycling. (~$80–120B/yr) |

| Urban Agriculture Segments |

|---|

| Vertical & Rooftop Farming — Efficient land use. (~$200–300B/yr) |

| Closed-Loop Systems — High efficiency. (~$100–150B/yr) |

| Local Food Hubs — Distribution. (~$120–160B/yr) |

| Advanced Growing Tech — Hydroponics + AI. (~$150–200B/yr) |

| Rooftop & Indoor Gardens — Household/community food. (~$80–110B/yr) |

| Policy & Land Access — Enabling frameworks. (~$60–90B/yr) |

| Urban Ag Jobs — Economic lift. (~$100–150B/yr) |

Green by design — Circular, transparent, climate-smart products could own a $1.3T slice of the future market.

| Energy Industry Segments |

|---|

| Building-Scale Solar — Rooftop PV. (~$0.8–1.2T/yr) |

| Energy Management Platforms — AI optimization. (~$0.3–0.6T/yr) |

| Efficiency Retrofits — Envelope + HVAC. (~$0.6–1.0T/yr) |

| Electrified Appliances — Heat pumps, induction. (~$0.5–0.8T/yr) |

| District Heating & Cooling — Central thermal. (~$0.2–0.4T/yr) |

| Smart Meters & Sensors — Real-time optimization. (~$0.1–0.2T/yr) |

| Energy-as-a-Service — Subscription model. (~$0.3–0.5T/yr) |

| Industrial Optimization — Automation + analytics. (~$0.4–0.6T/yr) |

| Water Industry Segments |

|---|

| Water Recycling — Grey + blackwater. (~$200–300B/yr) |

| Stormwater Management — Capture + reuse. (~$100–150B/yr) |

| Desalination — New freshwater. (~$80–120B/yr) |

| Smart Water Systems — Monitoring + AI. (~$150–200B/yr) |

| Decentralized Systems — Local treatment. (~$70–100B/yr) |

| Climate-Resilient Infrastructure — Flood/drought defenses. (~$100–150B/yr) |

| Water Equity — Underserved areas. (~$50–80B/yr) |

| Advanced Treatment — Membrane, UV, oxidation. (~$150–180B/yr) |

| Leak Detection — Sensors + analytics. (~$80–120B/yr) |

Reclaim everything — Circular water and next-gen treatment tech could make wastewater a $1.3T industry.

NYC is the launchpad — global reach, local power. Home to the UN, Wall Street, and 120+ consulates. A magnet for talent. A nexus for scale.

FiDi is the edge — Historic clout, future-ready. 13 subway lines, ferries, PATH, Citi Bike. Millions of square feet of vacant space.

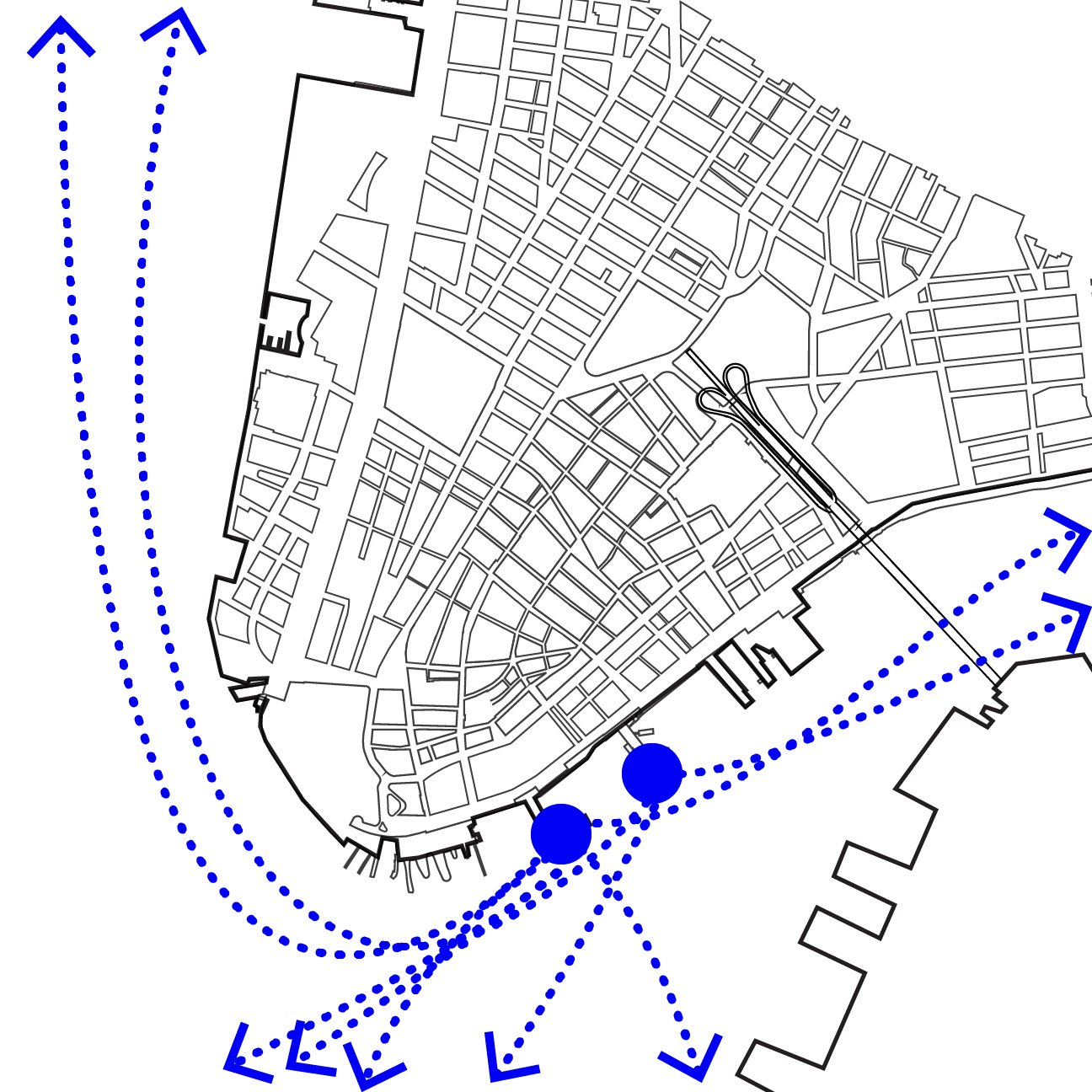

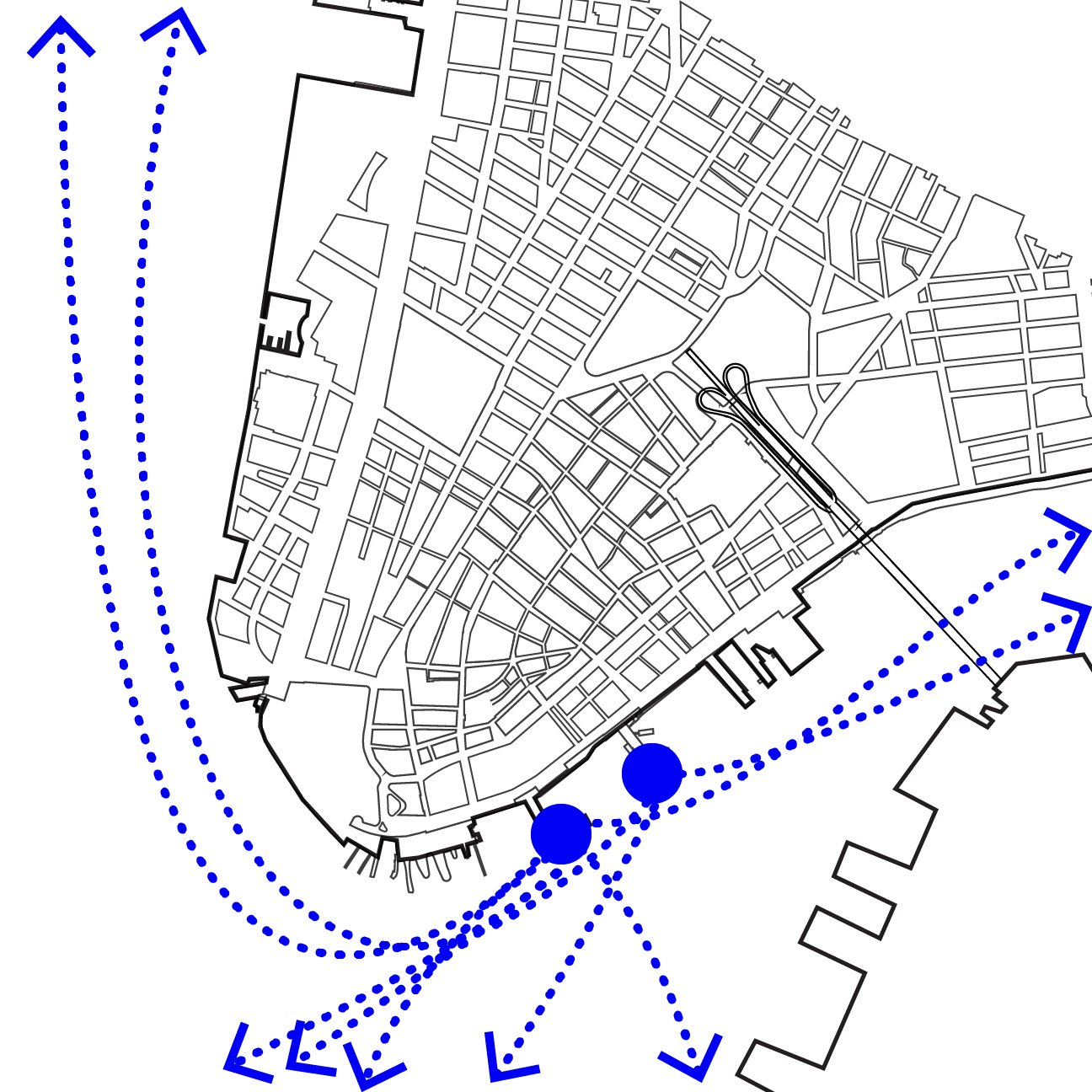

Well Connected Access is everything.

Fast to Activate Move in. Launch fast.

Blue Highway Water moves the future.

Hub Network Connected and scalable.

LMCR Built to endure.

Well Known Global name. Instant credibility.

Transit Connectivity — FiDi is the most transit-connected neighborhood in North America, with access to subways (13 lines), PATH, buses, ferries (17 lines), and bike stations, ensuring accessibility for global visitors and stakeholders.

Vacant Office Space Utilization — FiDi has over 30% office vacancy, offering prime space for flexible showrooms, exhibits, and events. This space can be transformed into hubs for climate innovation and trade.

Blue Highway — FiDi’s waterfront access supports NYC’s Blue Highway initiative, reducing truck traffic and emissions by shifting last-mile cargo to waterways and electric vehicles.

Regional Links — Access to Liberty State Park, Governors Island, and Brooklyn hubs—enabling overflow and cross-harbor mobility.

Coastal Resiliency — The Lower Manhattan Coastal Resiliency Project is transforming FiDi into a climate fortress with floodwalls, storm barriers, and resilient infrastructure, making it a model for adaptive urban design.

Historical and Economic Importance — FiDi is historically one of the most consequential neighborhoods globally, with a legacy of economic power and investment focus, making it ideal for driving climate commerce.

Vacant office and retail floors convert fastest and cheapest into showrooms. Minimal structural change, lower capital, and short build times. Compared to residential conversions, they deliver quicker ROI, lower risk, and faster impact.

| SUPPLY | Inventory | Vacant |

|---|---|---|

| Insurance | 12.6 msf | 4.7 msf |

| Finance East | 29.9 msf | 8.0 msf |

| Totals | 42.5 msf | 12.7 msf |

| DEMAND | Area Needed |

|---|---|

| Invent City Direct | 1.0 msf |

| Invent City Indirect | 1.5 msf |

| Totals | 2.5 msf |

Vacant Office Space Significant vacant space in FiDi

Vacant Retail Space High-profile, retail-oriented showrooms

Vacant Land Micro-cargo, transit, toilets

Under the FDR Along the East River

POPS Micro-cargo, transit, toilets

Educational Facilities Student programming and industry

Vacant Office Space — Repurpose FiDi’s vacant office floors into working showrooms and live deployments. A modern take on the Trade Mart. For property owners, these floors are hard to convert to residential. Showrooms offer a faster, lower cost path and drive demand for office support services.

Vacant Retail Space — FiDi has the highest retail vacancy rate in NYC. Of 2,305 storefronts in CB1, 556 are empty. Source

Vacant Land — Some lots were cleared for towers that never came. With office vacancies above 30%, new offices are unlikely. Deploy temporary to permanent innovation: micro-grids, stormwater parks, solar canopies, pavilion showrooms.

Under the FDR — Privately finance upgrades in exchange for curated exhibits and programming. Ferry access. Pier 17. Water exhibits. Showrooms on barges.

Privately Owned Public Spaces (POPS) — Indoor or outdoor public spaces often needing upgrades. See the Municipal Art Society and NYC Planning.

Educational Facilities — Ideal for summer programming linking students with industry leaders. Examples include Pace University, Peck Slip High School, and High School of Economics and Finance.

Neighborhood-scale systems — Complementing the Blue Highway, Invent City promotes hubs for micro-cargo, micro-transit, waste transfer, and public toilets to cut congestion and boost efficiency.

An urban “nervous system” for the cluster and Trade Mart — a shared data spine linking every part of the city. Predictive, adaptive, finance-ready. What was once fragmented becomes a living, optimizing system.

AI deployed in NYC >AI in Cities Worldwide

Nairobi 2025: 5.77M • 2100: 46.66M

Singapore 2025: 6.11M • 2100: n/a

Jakarta 2025: 11.63M • 2100: 18.22M

Seoul 2025: 10.03M • 2100: n/a

Copenhagen 2025: 1.40M • 2100: n/a

Tokyo 2025: 37.04M • 2100: 25.63M

Amsterdam 2025: 1.19M • 2100: n/a

Pittsburgh 2025: 1.72M • 2100: n/a

Barcelona 2025: 5.73M • 2100: 6.06M

AI-timed signals — Crop diagnosis by phone; flood-risk alerts along the Ngong.

City digital twin — Smart lampposts; AI dengue hot-spot prediction.

AI flood forecasting — Adaptive traffic control; waste-sorting vision pilots.

Citywide digital twin — AI CCTV; subway crowding forecasts in real time.

“Green-wave” AI for bikes — District-heat optimization; storm surge decision support.

Predictive metro maintenance — Quake damage mapping; service robots in stations.

AI-managed canals — Smart mobility pricing; building-energy tuning.

CMU smart signals — AV testbeds; bridge inspection with computer vision.

CityOS + IoT — AI leak detection; smart lighting & traffic tuned block-by-block.

Invent City never sleeps — its marketing engine runs nonstop, turning moments into momentum. Live events, digital drops, and immersive media keep the Trade Mart buzzing long after the handshake.

Events Showcase NYC

Podcasts Global Interaction

Incubate / Deploy From Pilot to Scale

Events — Events extend the Trade Mart’s market reach, activate buyer networks, and compress sales cycles.

Podcasts — On-demand conversations scale globally, keep brands top of mind, and create evergreen discovery paths.

Metaverse — Persistent virtual showrooms expand geographic reach and maintain contact between live events.

Benefits

for NYC,

for Business

General Economic Growth from Creating a Cluster — Invent City turns FiDi into a real-time showcase of AI in action, drawing companies, suppliers, and talent while activating restaurants, cafés, and services.

Attract Companies Global firms + startups

Regional Spillover Tri-state growth

Tourism & Business Travel — Invent City reinforces Lower Manhattan as a global crossroads for innovation, drawing delegations and buyers that fill hotels, restaurants, shops, and transit—creating a measurable, recurring economic flywheel.

| Stay | Origin | Purpose | Visitors | Per-trip Spend | Economic Impact ($ Millions) | ||

|---|---|---|---|---|---|---|---|

| Direct | Indirect + Induced | Total | |||||

| 0.55 | |||||||

| Overnight | Domestic | Business | 504,000 | $860 | $433 | $238 | $672 |

| Overnight | Domestic | Leisure | 126,000 | $400 | $50 | $28 | $78 |

| Overnight | International | Business | 216,000 | $2,000 | $432 | $238 | $670 |

| Overnight | International | Leisure | 54,000 | $1,538 | $83 | $46 | $129 |

| Day | Domestic | Business | 56,000 | $160 | $9 | $5 | $14 |

| Day | Domestic | Leisure | 14,000 | $160 | $2 | $1 | $3 |

| Day | International | Business | 24,000 | $160 | $4 | $2 | $6 |

| Day | International | Leisure | 6,000 | $160 | $1 | $1 | $1 |

| Totals | $1,015 | $558 | $1,573 | ||||

| Stay | Origin | Purpose | Taxes @ 8.61% |

|---|---|---|---|

| Overnight | Domestic | Business | $57,844,735 |

| Overnight | Domestic | Leisure | $6,726,132 |

| Overnight | International | Business | $57,652,560 |

| Overnight | International | Leisure | $11,083,705 |

| Day | Domestic | Business | $1,195,757 |

| Day | Domestic | Leisure | $298,939 |

| Day | International | Business | $512,467 |

| Day | International | Leisure | $128,117 |

| Totals (annual) | $135,442,412 | ||

| Stay | Origin | Purpose | Direct Spend | Indirect + Induced (0.55×) | Total Impact (1.55×) | Jobs Supported |

|---|---|---|---|---|---|---|

| Overnight | Domestic | Business | $433 M | $238 M | $672 M | 3,300 |

| Overnight | Domestic | Leisure | $50 M | $28 M | $78 M | 384 |

| Overnight | International | Business | $432 M | $238 M | $670 M | 3,289 |

| Overnight | International | Leisure | $83 M | $46 M | $129 M | 632 |

| Day | Domestic | Business | $9 M | $5 M | $14 M | 68 |

| Day | Domestic | Leisure | $2 M | $1 M | $3 M | 17 |

| Day | International | Business | $4 M | $2 M | $6 M | 29 |

| Day | International | Leisure | $1 M | $1 M | $1 M | 7 |

| Totals (annual) | $558 M | $1,573 M | 7,726 | |||

Targeted Visitation — The Trade Mart drives recurring business travel and events filling 10 000 + hotel rooms annually. Regional Impact — Ripple effects strengthen supply chains across the tri-state area as fabricators and vendors gain steady demand.

| Bucket | SF | Showroom/Office Staff | Building Ops FTE | Total On-site Jobs |

|---|---|---|---|---|

| Direct (showrooms) | 1,000,000 | 1,000 | 110–120 | 1,110–1,120 |

| Knock-on (offices) | 1,500,000 | 8,571 | 175 | 8,736–10,180 |

| Total | 2,500,000 | 9,571 | 275–300 | 9,846–11,300 |

| Bucket | SF | Rent $/SF | Rent ($M) | Property Tax (≈28%) | Commercial Rent Tax (≈3.9%) | Total Taxes |

|---|---|---|---|---|---|---|

| Direct | 1,000,000 | $40 | $40 M | $11 M | $2 M | $13 M |

| Knock-on | 1,500,000 | $60 | $90 M | $25 M | $4 M | $29 M |

| Total | 2,500,000 | — | $130 M | $36 M | $5 M | $41 M |

Crossing the Chasm From pilot to scale.

DOOH District Every wall is media.

Buy / Sell Where commerce happens.

Expand & Deepen Stay visible. Stay connected.

Real Estate Repositioning — Converts underused floors into active, profitable spaces that lift building value and stabilize occupancy.

Retail Impact Without Crowds Activating vacant space.

Real Estate Catalyst Driving FiDi’s revival.

Global Accelerator — Positions NYC as a world hub for scalable climate solutions linking growth and sustainability.

Faster Deployment — Speeds adoption of clean energy, mobility, and building technologies to reach net-zero faster.

Urban Leadership — Reinforces NYC’s standing as a model for sustainable transformation.

Nature-Based Resilience — Integrates greening, stormwater capture, and adaptive systems that protect FiDi and cool the city.

Public Engagement — Immersive showrooms let people see and experience sustainable living.

Replicable Blueprint — Establishes a carbon-zero model any dense, historic city can follow.